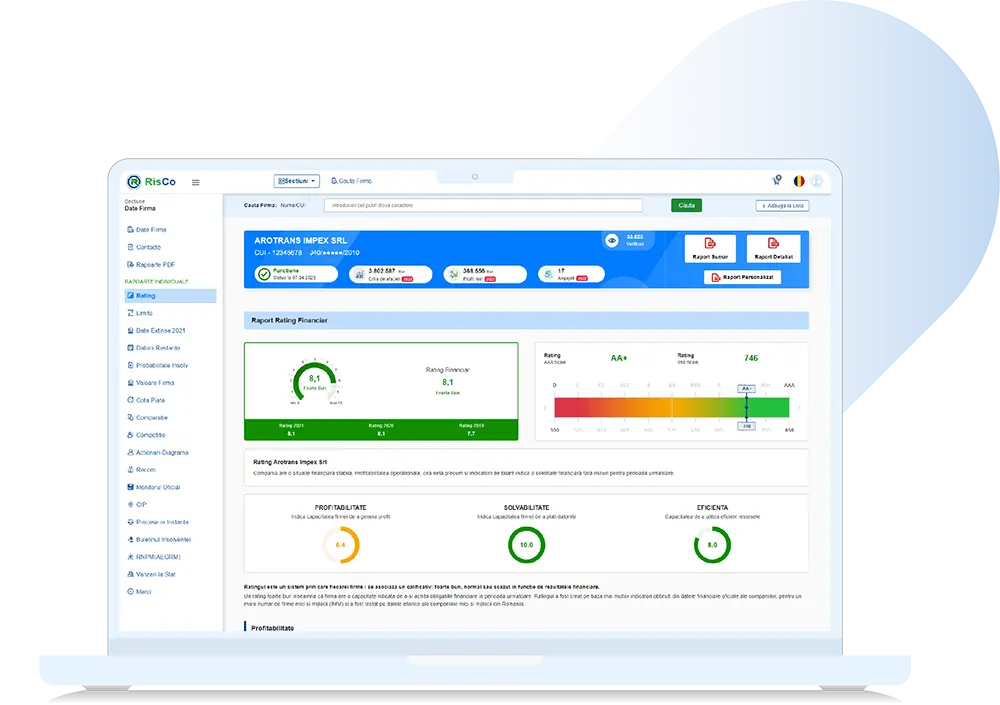

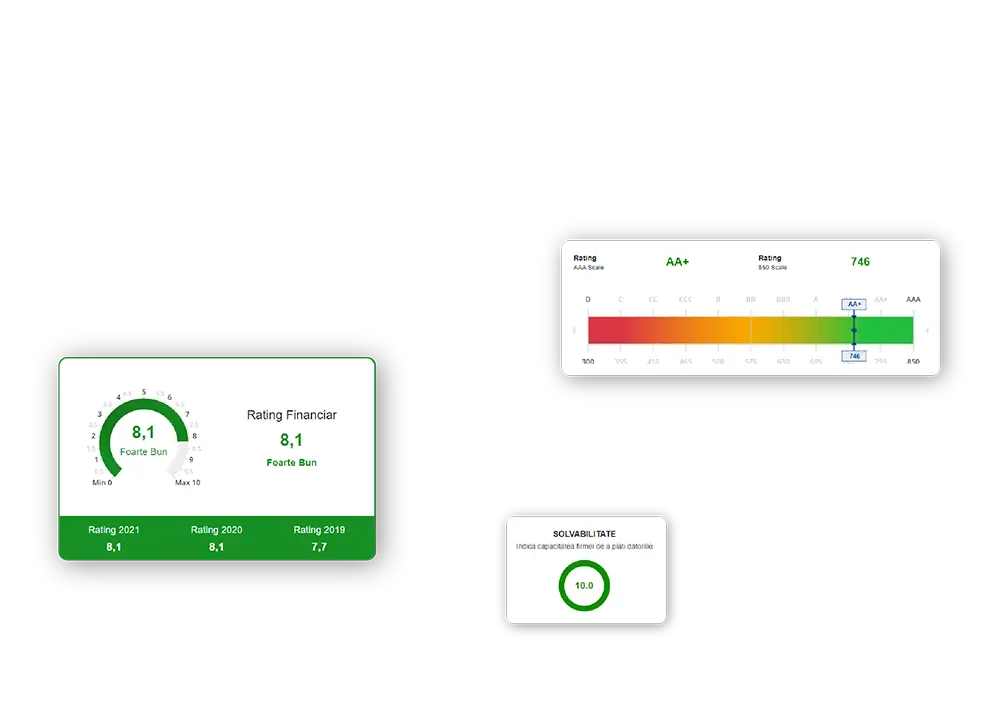

What is the report Financial Rating?

A very good rating means that the company has a high capacity to pay its financial obligations in the next period, compared to a low rating that shows us that the company is in a situation financial unstable.

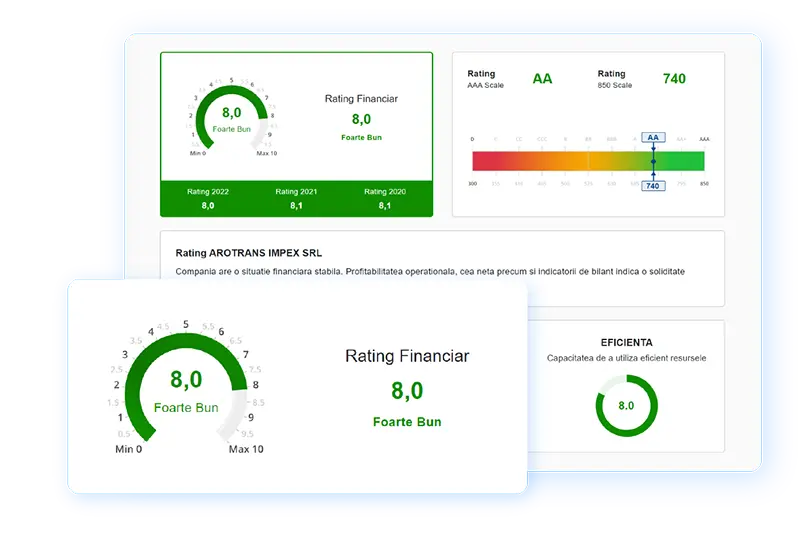

Rating Very Good

The company has a stable financial situation. The operational and net profitability as well as the balance sheet indicators indicate a risk-free financial solidity for the next period.

The rating was created based on several indicators obtained from the official financial data of the companies, for a large number of small and medium enterprises (SMEs) and was tested on the historical data of small and medium companies in Romania.

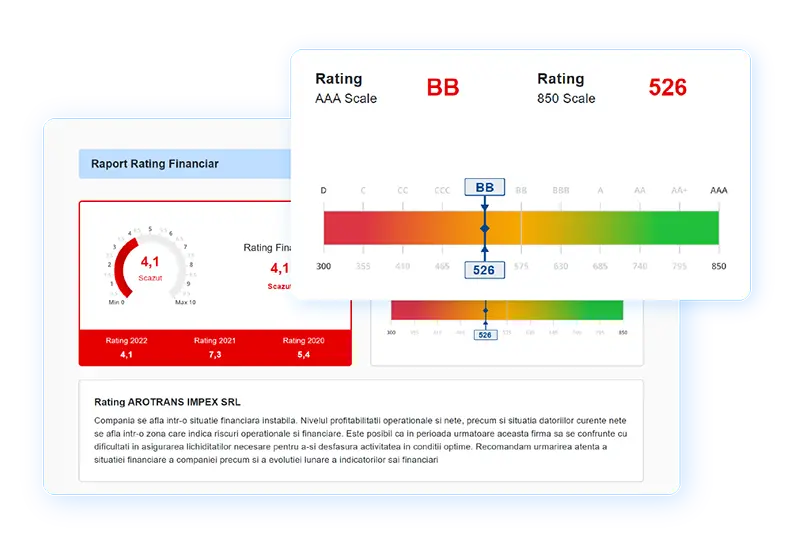

Low Rating

The company is in an unstable financial situation. The level of operational and net profitability, as well as the situation of net current liabilities, is in an area that indicates operational and financial risks. It is possible that in the next period this company will face difficulties in ensuring the necessary liquidity to carry out its activity in optimal conditions. We recommend carefully following the financial situation of the company as well as the monthly evolution of its financial indicators.

How the report helps you Financial Rating?

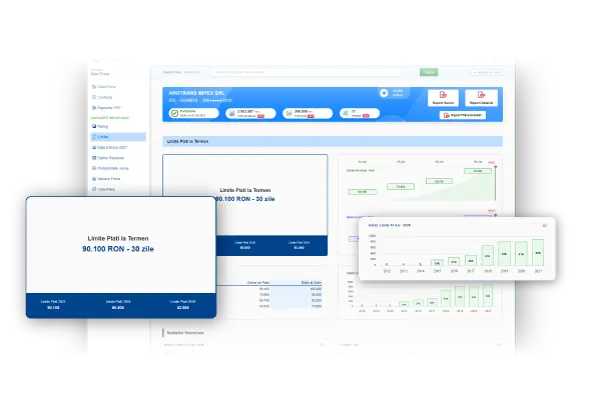

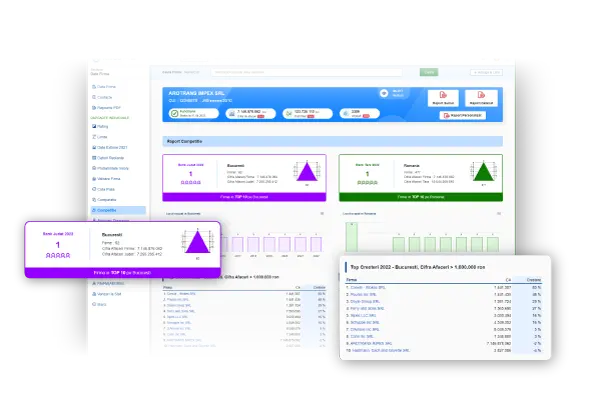

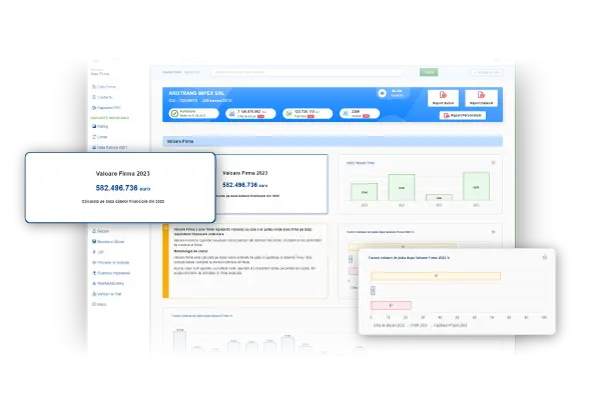

Indicates the size of the company, its profitability and financial stability

Depending on these indicators, you can see if the company is among the largest in the respective field, if it is a performer in the industry or if it meets the conditions of a commercial relationship that you want.

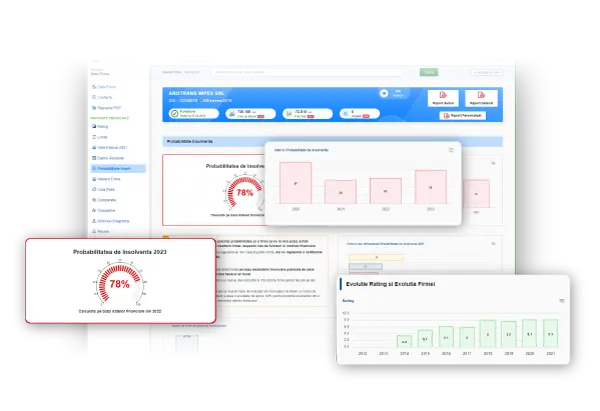

Indicates the degree of risk associated with the company regarding the activity to be carried out in the next period

The associated risks result from the 3 major categories of analyzed indicators: profitability, solvency and efficiency. The most important risks and their potential consequences are the following:

- ✔ Low profitability: the company has a certain degree of risk with the actions of the competition - if it reduces prices, then it is possible that the company will have to sell at a loss or reduce its income.

- ✔ Low solvency: the company is highly exposed to loans from financial institutions, suppliers and/or the state budget and may encounter significant financial problems in covering debts.

- ✔ Low efficiency: the company has a significantly longer operating cycle than the sector it belongs to. The longer the operating cycle, the more the company is exposed to external risks (market, competition, macroeconomic conditions, etc.).

Detailed analysis of the most important financial indicators and possible comparisons with other competing companies

Through the detailed analysis of the indicators you can determine in detail multiple aspects regarding the activity of a company: the financing method, the financial and operational management, the profitability structure, the investment policy, etc.

Identify your need, choose customized solutions and enjoy the facilities that we make available to you for free during the test period!

Test for Free