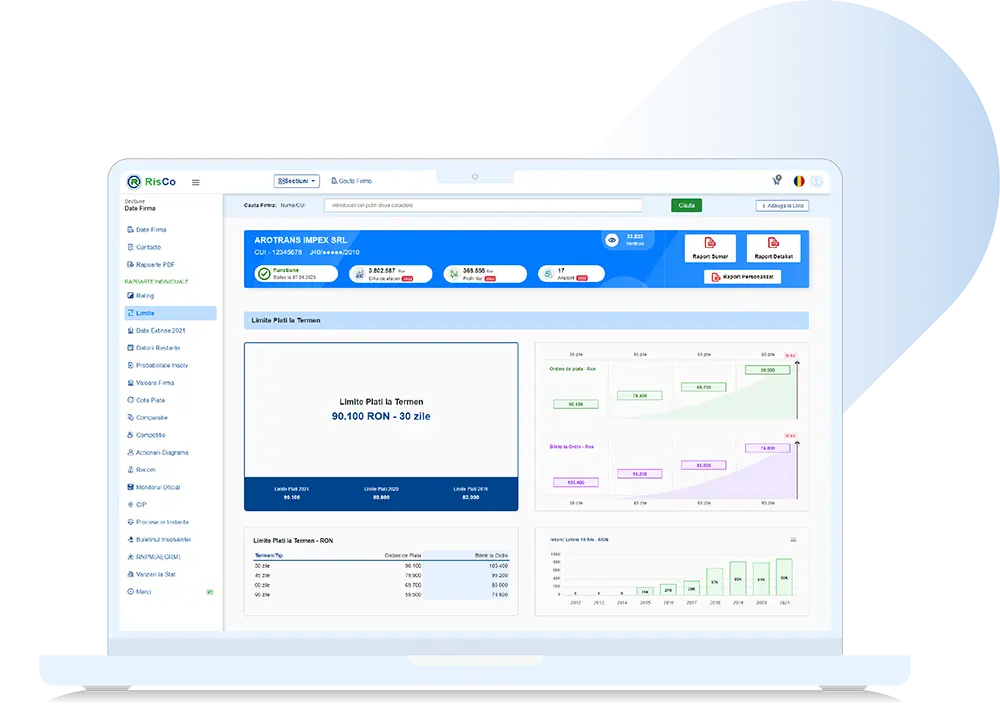

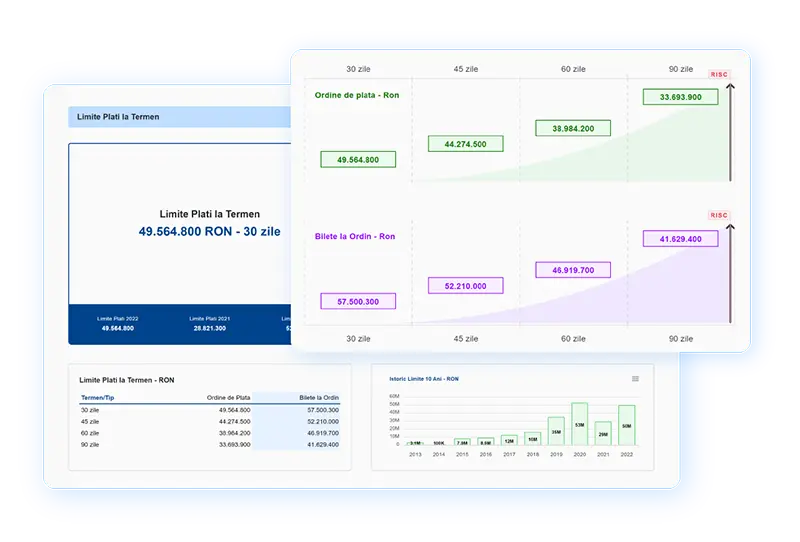

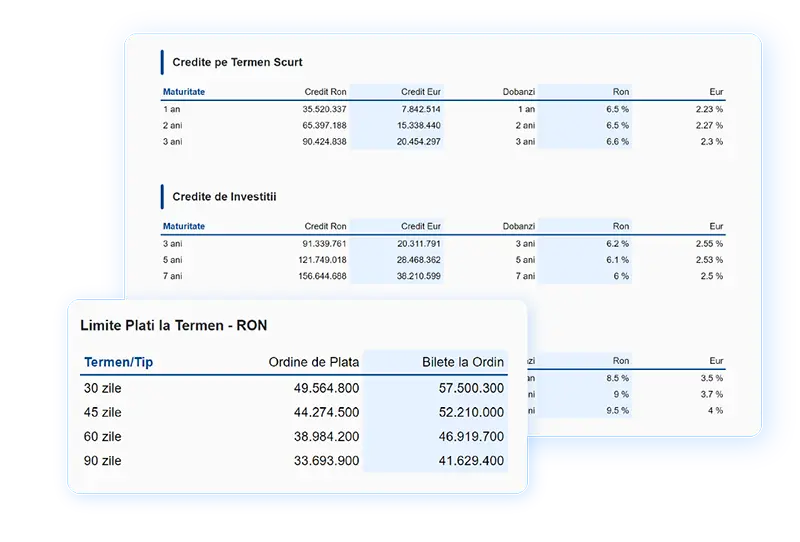

What is the report Term Payment Limit?

Term Payment Limits represent the maximum amounts in lei for which suppliers can offer their customers goods or services with payment on time

Term Payment limits indicate a maximum working ceiling between companies so that the supplier does not provide goods or services disproportionate to the client's ability to pay. Thus, the supplier may avoid the payment risk from its clients.

How the report helps you Term Payment Limit?

It indicate the trade limits for acceptance of invoices with term payment

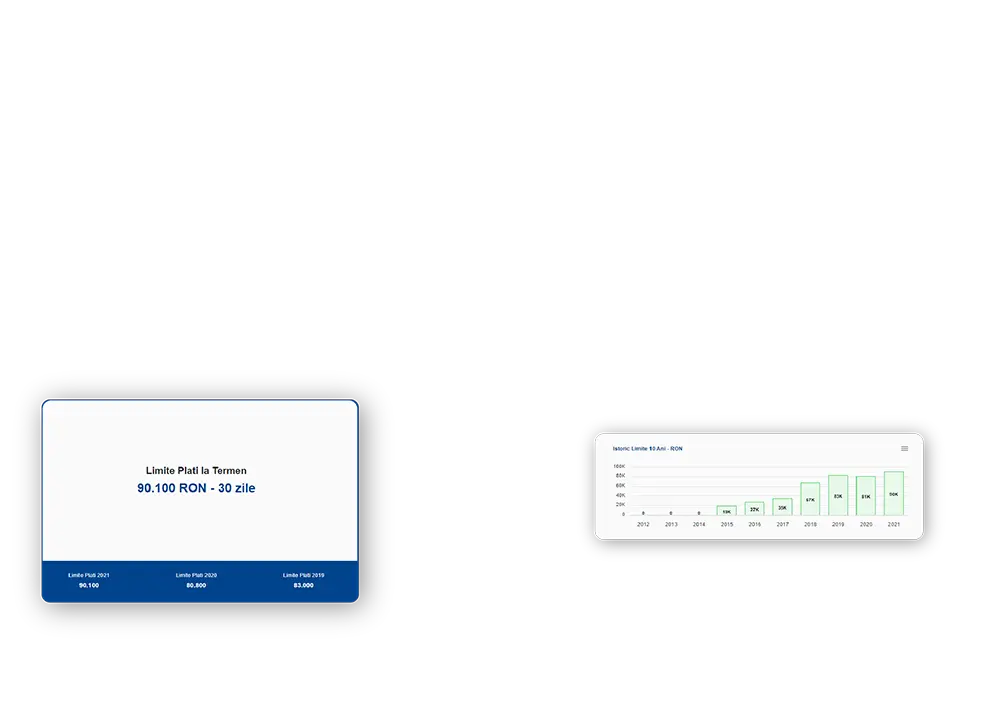

The limits are the maximum amounts that a supplier can grant to a company in the case of invoices paid at various terms by payment order. For this reason and to limit the risks of non-payment of invoices, suppliers must grant limits to each client depending on the situation financial and its history.

Indicates the limits for payment with promissory notes and checks

Term payment instruments, promissory notes and checks, are means of paying invoices and if they are not paid on time, then the non-paying company is registered in the Central Payment Incidents Due to these negative consequences, companies are much more cautious in the issuance of these instruments and, consequently, the payment limits are higher than in the case of invoices paid by payment order.

The limits are differentiated by the usual payment terms

Depending on the accepted payment term, the supplier takes a higher or lower risk of non-payment. A period of 30 days has a much lower risk of default than a period of 90 days.

Term Payment Limit are theoretical. These can be adjusted based on the payment history

The limits presented in the report are theoretical and are determined based on financial indicators. Depending on the policy of each company, these limits can be adjusted according to the desired degree of risk. However, it is recommended that these limits are not exceeded by significant values.

Identify your need, choose customized solutions and enjoy the facilities that we make available to you for free during the test period!

Test for Free