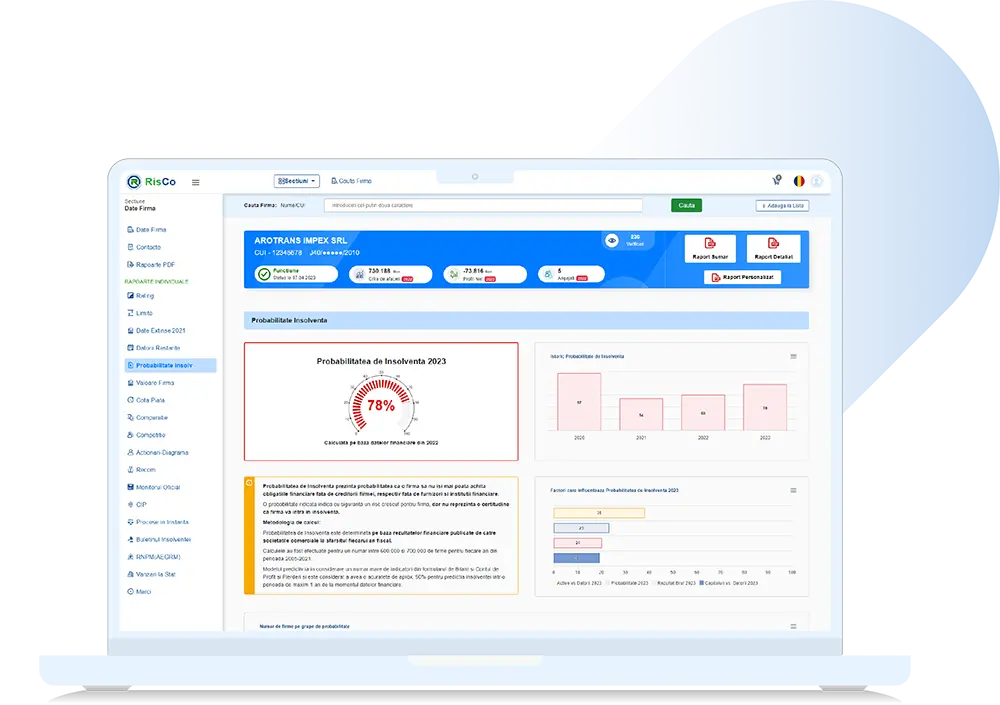

What is the report

Probability of Insolvency?

Probability represents an estimate of the degree to which a company can enter insolvency.

A high probability certainly indicates an increased risk for the company, but it does not represent a certainty that the company will go into insolvency.

How the report helps you

Probability of Insolvency?

Probability of Insolvency calculated for the last 4 years

The calculation of the probability of insolvency for the last 4 years provides an image of the increasing trend of the risk associated with the company in the recent period. The probability values are directly correlated with the financial performance of the company (debts, capital, profitability, etc.) and for this reason they can alternate.

Statistics on the number of companies by insolvency groups

The statistics serve to position the company from the point of view of probability in the totality of companies. This statistic will indicate whether the company is placed among high-risk or low-risk companies.

The probability of Insolvency is a theoretically determined indicator

Probability represents an estimate of the degree to which a company can enter insolvency. It does not provide any certainty regarding the entry into insolvency or not.

Identify your need, choose customized solutions and enjoy the facilities that we make available to you for free during the test period!

Test for Free